Getting My How To Obtain Bankruptcy Discharge Letter To Work

Table of ContentsThe 45-Second Trick For Chapter 13 Discharge Papers8 Simple Techniques For Obtaining Copy Of Bankruptcy Discharge PapersIndicators on How To Get Copy Of Bankruptcy Discharge Papers You Should Know5 Easy Facts About Obtaining Copy Of Bankruptcy Discharge Papers Described

For small company proprietors with lots of individual financial obligation, personal bankruptcy may aid them continue to remain in organization. It is very important to keep in mind that organization financial obligations aren't minimized with Chapter 7 or Chapter 13 unless you're a single proprietor and are personally in charge of them. For single owners, service and also personal financial debts can be erased in a single personal bankruptcy instance. https://www.ulule.com/b4nkrvptcydcp/#/projects/followed.Some organization properties can be excluded from Chapter 7 personal bankruptcy filings. If your service is service-based as well as does not preserve equipment or substantial inventory, you can likely proceed to run your organization after releasing business financial obligations through insolvency.

In a bankruptcy request, your home as well as home loan will certainly be kept in mind as possessions to determine your capacity to settle.

Your house is not sold off, and you are accountable for paying your lending under the terms established by your payment plan under the bankruptcy. If you select to declare your home loan in a Phase 7 personal bankruptcy, you could be stuck with the responsibility for your loan after your insolvency procedures. If you're not able to pay off, you will not have the ability to declare Chapter 7 personal bankruptcy once again for numerous years, as well as creditors may have the ability to sue you to collect on the loan.

The Only Guide to Bankruptcy Discharge Paperwork

After completing the course, you should send a request to the U.S. insolvency court in the federal judicial area where you live. This request will list your: Possessions, such as autos, homes, and also checking account Regular monthly earnings and costs Financial institutions as well as just how much you owe them You'll also need to submit a duplicate of your newest tax return with your request.

The only people exempted from this are impaired experts declaring insolvency to discharge financial obligation incurred while they were on active military task or people with debt that originates from running a company. The document of your insolvency will certainly remain on your credit scores report for ten years. However, for lots of people, Chapter 7 supplies a fresh begin.

Phase 13 allows individuals to settle their debts over a duration of three to 5 years - copy of chapter 7 discharge papers. For people that have regular, foreseeable annual revenue, Chapter 13 supplies an elegance period. Any debts remaining at the end of the moratorium are discharged. As soon as the insolvency is accepted by the court, lenders must quit contacting look here the borrower.

The smart Trick of Copy Of Bankruptcy Discharge That Nobody is Talking About

Many people take their economic commitments seriously and wish to pay their debts completely, however recognizing when to file insolvency and when to work out or use another approach can assist put you on the roadway to financial health. Here are a checklist of concerns that can aid you evaluate your financial health and provide you insight into whether bankruptcy may be right for you (chapter 13 discharge papers).

Charge card commonly lug high rates of interest on open equilibriums. This implies that your equilibrium can quickly swell if you're only making minimum settlements. If your equilibrium was high to start with, it might spiral out of hand quickly. Continuous call from collectors can be annoying and demanding reminders of your financial debt - https://www.openlearning.com/u/robertingram-rev84c/about/.

Debt stems from many resources. Consolidating your payments right into one large financing can help you extra conveniently keep track of superior financial obligations with one regular monthly payment. how to get copy of chapter 13 discharge papers.

It can be hard to face downsizing from a residence or obtaining rid of a vehicle, yet taking these tough steps might allow you to repay financial debts as well as avoid a bankruptcy declaring. Your costs need to ideally be covered by your earnings with some buffer area for emergencies. If your regular monthly settlements surpass your take-home income, you're a possible candidate for personal bankruptcy.

The How To Get Copy Of Chapter 13 Discharge Papers Statements

Whether your equilibriums have enlarged and also you're not aware of the total amount, or you've neglected creditors that have sent your financial debt to collections, you need to think about alternate repayment options if you can not arrange just how much you owe. Bankruptcy does not deal with all debt indiscriminately. Some debts, such as student loans, can not be released in personal bankruptcy.

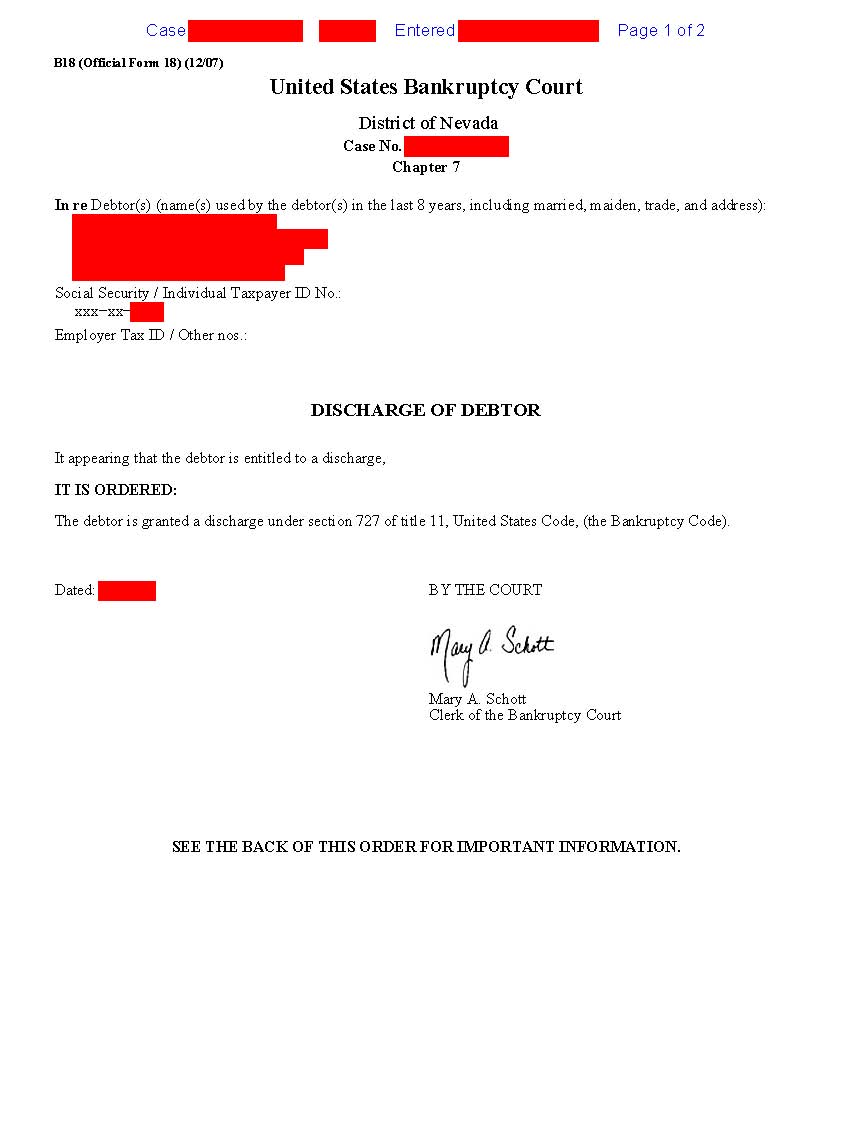

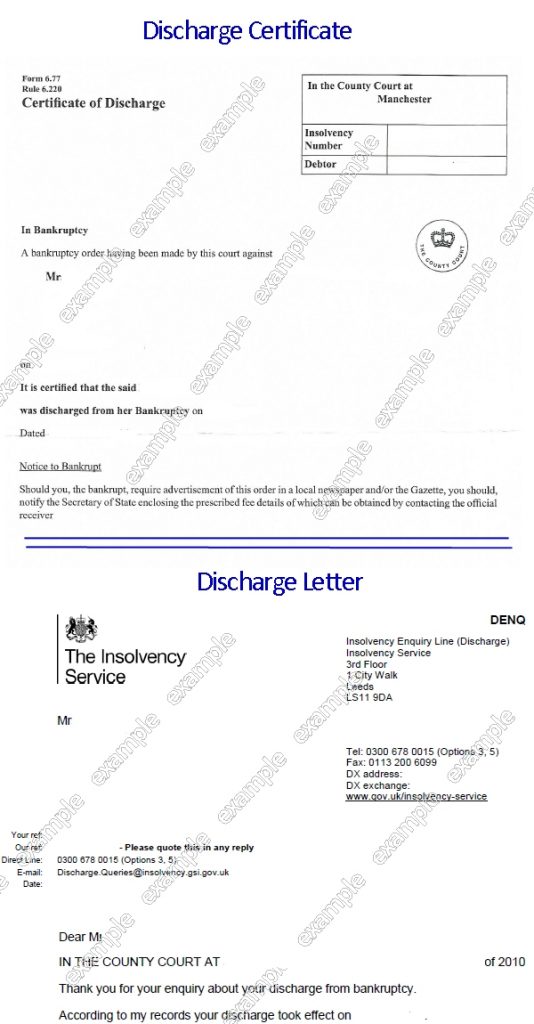

An equated duplicate of the Bankruptcy Info Sheet is available in Adobe PDF format in the several languages. Please evaluate links in the box to the. You can choose the kind of personal bankruptcy that best meets your needs (provided you meet specific qualifications): Chapter 7 A trustee is assigned to take over your property.